Nearly forty years after Ronald Reagan’s “Star Wars” dream promised to protect the United States from nuclear hellfire, the idea has returned, bigger, flashier, and far less clear. President Donald Trump’s new “Golden Dome” initiative, aims to create an Israeli Iron Dome-style missile defence system which would protect the continental U.S. from drones, hypersonic missiles, and intercontinental strikes. The name is gaudy, which is in character for this administration, but the ambition is not as absurd as some push it to be, the true danger is in its obscurity.

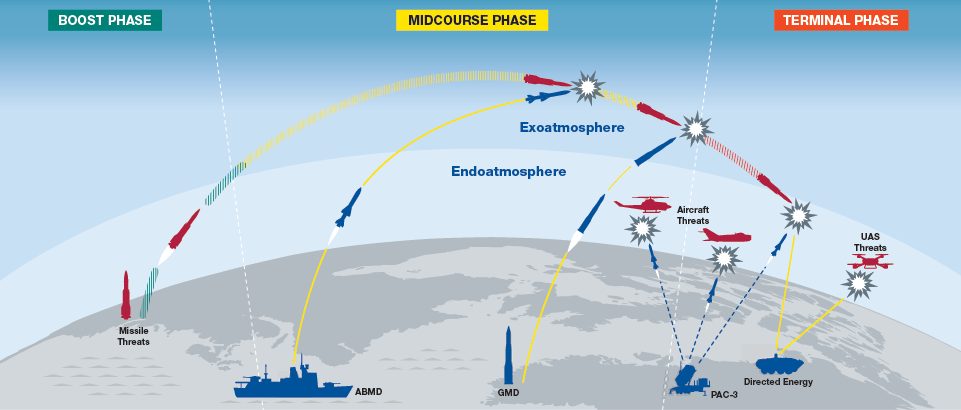

To understand the stakes, we must know what the “Golden Dome” really is. It includes things that already exist, such as the Patriot batteries, THAAD, along with others. On top of that it includes things that have been in the works for years now, such as enhanced missile detection & interception tools.

However, there are new pieces to this puzzle. Just as Trump has revived old Neo-Conservative ambitions, he continues to echo Ronald Reagan and George H. W. Bush’s vision for a Strategic Defensive Initiative system, that are orbital weapons that would destroy incoming ballistic and hypersonic missiles during their boost phase, long before they can come close to their target.

With the scope now clear, we can understand how it will be one of the most ambitious (and expensive) projects to date. It could lead to major changes in American military strategy. Critics claim that it is another pyre for tax-payer funds. However its supporters, which are often non-MAGA, claim that something like this is long overdue.

Now President Trump’s plan is named after Israel’s Iron Dome, but are they truly similar? The answer is a resounding no. The Israeli Iron dome protects a small country against small missiles sent over by Hamas or by Palestine Islamic Jihad, not a vast country facing hypersonic missiles by China.

Now let us leave the hypothetical, how would this actually be done? America’s Department of War says it has a rough sketch, but is yet to release any details. What is known is that the Golden Dome would not be a single system, but a complex network of technologies.

The cheapest option for the supposed Golden Dome is one focused on drones, cruise missiles, and planes; this alone would still cost $250 billion. The most lavish idea is designed to block threats of almost all kinds, including the ICBMs used by North Korea. This could amount to almost $3.6 trillion, according to the American Enterprise Institute.

The involvement in space would drive much of the cost. Even a basic orbital system would have to be enormous, since interceptors can’t always be positioned over the right regions. The only way to compensate for that is to have sheer quantity.

But is this a Good Idea?

Critics claim the Golden Dome is an unrealistic and economically destabilizing proposal which revives the failure of Reagan’s “Star Wars” program. They claim that the system’s $175 billion estimate is vastly understated, given that similar space-based interceptor projects cost well over $500 billion. The U.S. already possesses limited defense systems that they argue is more suitable for the much more likely small-scale threats, and a nationwide shield against intercontinental missiles is technologically impossible within three years.

Beyond the cost and practicality, critics also say the plan risks undermining nuclear deterrence by giving rivals like Russia and China another reason to expand their arsenals, which could trigger a fresh arms race.

However, proponents see it much differently. They argue that the Golden Dome represents a necessary evolution in U.S. defense strategy amid rapidly advancing missile and drone technologies. They contend that existing systems like THAAD and Aegis were designed for limited threats from the time where the biggest aggressor to the U.S. was loosely banded terrorist organizations and insurgents grabbing onto the last stockpile of weapons they had. These were not in the emerging era of hypersonic and long-range precision strikes from adversaries such as China, Russia, and North Korea. Supporters also claim that investing in a comprehensive, layered missile defense network would not only deter attacks but also drive more innovation in defense industries. To them, “Golden Dome” is less of a reckless gamble than a long-overdue modernization incentive which would ensures the U.S. can meet future threats.

Our Take

The Golden Dome is undeniably an impressive idea on paper, but it has that all too common risk of turning into an overbuilt symbol of security instead of the promised long term defense solution. In a situation where the lowest estimates already stretch into the hundreds of billions, without even considering the systems staggering maintenance expenses, it is just very hard to justify a nationwide system when the credible threats could be addressed with much less. We believe that a realistic approach should focus on protecting major metropolitan and strategic areas rather than the whole country at once. The best course of action is concentrating these advanced systems around population centers, military bases, and infrastructure hubs, this would be far cheaper, faster to build, and far more likely to work as intended. For now, the Golden Dome seems less like a shield for America and more like a flashy symbol of power meant to project strength, rather than truly ensure it.